What’s fair in this case?

Morgan Reed

Contributing Writer

Print this recipe

When two individuals decide to move in together, it often marks a significant step in their relationship. However, it also brings about practical challenges, particularly when it comes to sharing financial responsibilities. One common issue is how to fairly split rent when there is a disparity in income.

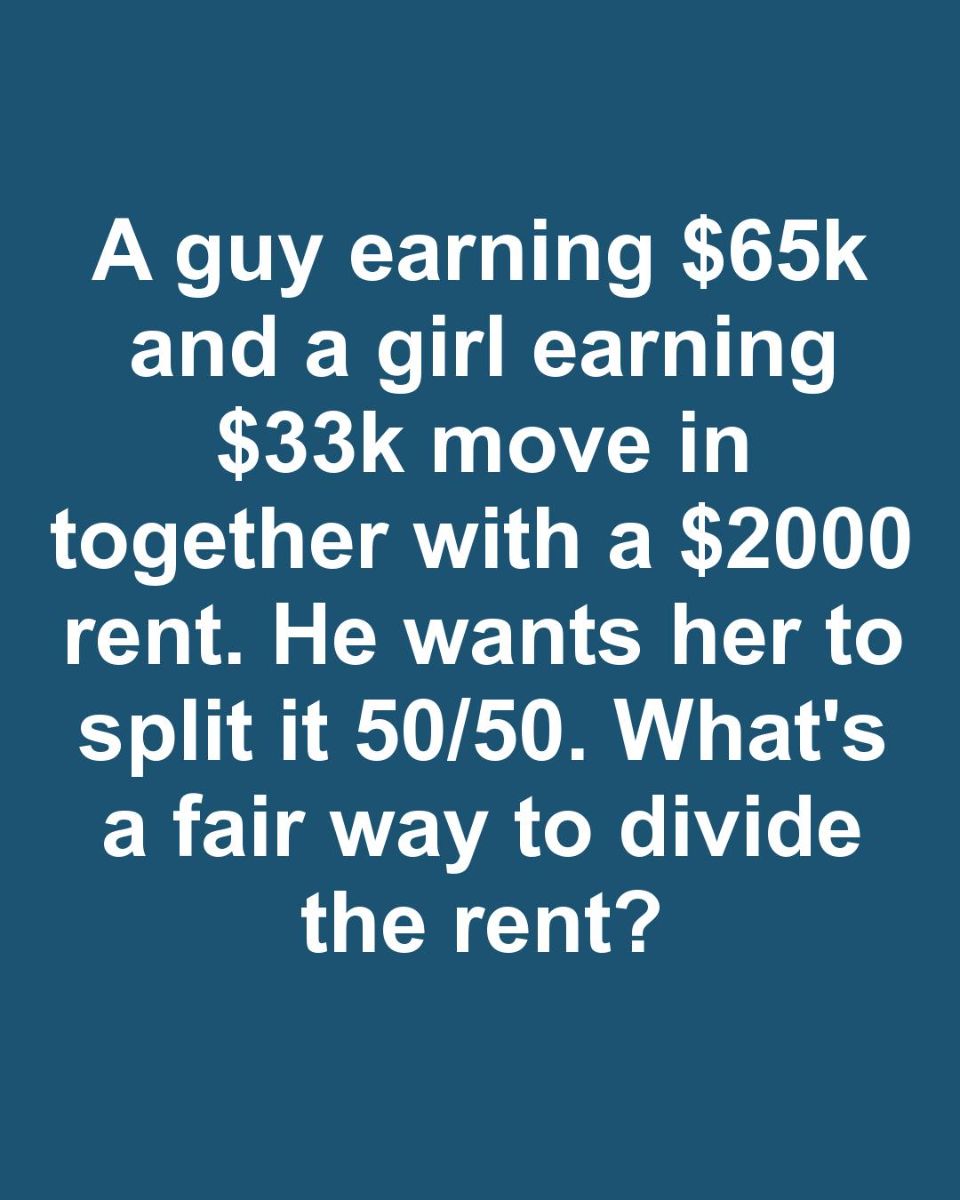

In this scenario, a man earning $65,000 annually and a woman earning $33,000 are faced with a $2,000 monthly rent. The question arises: should they split the rent equally, or is there a more equitable way to divide this expense?

Assessing Income Disparities in Cohabiting Couples

Income disparity is a common scenario among couples, and it can lead to tension if not addressed thoughtfully. With one partner earning nearly double the income of the other, a 50/50 rent split might not reflect the financial realities of each individual. Understanding each partner’s financial situation, including income, debts, and other obligations, is crucial in determining a fair rent division that respects both parties’ financial health.

Method 1: Income Proportionate Rent Split

One approach to addressing income disparity is to split the rent proportionally based on each partner’s income. In this case, the man earns approximately 66% of the total household income, while the woman earns 34%. Applying these percentages to the $2,000 rent, the man would pay $1,320, and the woman would pay $680. This method ensures that each partner contributes to the rent in a way that reflects their financial capacity.

Method 2: Flat Percentage of Income Contribution

Another method is for each partner to contribute a flat percentage of their income towards rent. For example, both could agree to allocate 30% of their income to rent. This would mean the man pays $1,625 (30% of $65,000/12 months), and the woman pays $825 (30% of $33,000/12 months). This approach ensures that neither partner is overburdened relative to their earnings.

Method 3: Equal Value Contributions Beyond Rent

Couples might also consider equalizing their contributions by factoring in other shared expenses. If rent is split equally, the partner with the lower income could take on a greater share of other household responsibilities, such as groceries or utilities, to balance the overall financial contribution. This method requires a comprehensive view of all shared expenses and a willingness to negotiate responsibilities beyond rent.

The Importance of Open Communication in Financial Decisions

Open communication is vital when making financial decisions as a couple. Discussing each partner’s financial situation, expectations, and concerns can prevent misunderstandings and resentment. It’s important to approach these conversations with empathy and a willingness to compromise, ensuring that both partners feel heard and respected.

Considering Other Shared Expenses and Their Impact

Rent is just one part of the financial puzzle when living together. Couples should also consider how they will handle other shared expenses such as utilities, groceries, and entertainment. These costs can add up and should be factored into the overall financial strategy. A comprehensive budget that includes all shared expenses can help ensure that both partners are contributing fairly to the household.

Impact of Financial Stress on Relationships