Considering Other Shared Expenses and Their Impact

Rent is just one part of the financial puzzle when living together. Couples should also consider how they will handle other shared expenses such as utilities, groceries, and entertainment. These costs can add up and should be factored into the overall financial strategy. A comprehensive budget that includes all shared expenses can help ensure that both partners are contributing fairly to the household.

Impact of Financial Stress on Relationships

Financial stress can have a significant impact on relationships, leading to tension and conflict. Disparities in income and disagreements over money management are common sources of stress. Addressing these issues proactively and finding a fair way to manage shared expenses can help mitigate financial stress and strengthen the relationship.

Legal Considerations for Cohabiting Couples

Couples living together should also be aware of the legal implications of cohabitation. While not married, cohabiting partners may still face legal issues related to shared property and financial obligations. It’s wise to consider a cohabitation agreement that outlines each partner’s rights and responsibilities, providing clarity and protection for both parties.

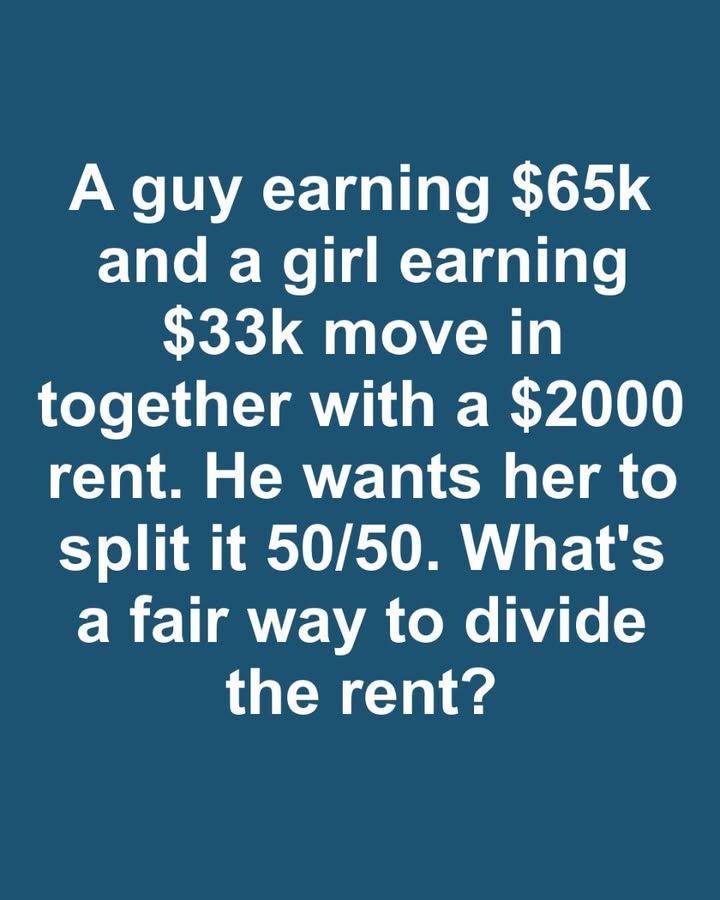

Conclusion: Finding a Fair and Balanced Approach

Ultimately, there is no one-size-fits-all solution to dividing rent among cohabiting couples with disparate incomes. The key is to find a method that both partners agree is fair and sustainable. Whether through proportional contributions, flat percentages, or balancing other expenses, the goal is to ensure that both individuals feel comfortable and respected in their financial arrangement. Open communication, empathy, and a willingness to adapt are essential in achieving a harmonious living situation.